The Best Way to Keep Track of Your Travel Credit Cards

The Mobile Homie contains affiliate links and is a participant in the Amazon Services LLC Associates Program, as well as other affiliate programs. If you click on a link or make a purchase through one of these links, we may earn a small commission at no extra cost to you. For more details, see our Privacy Policy.

Opening a credit card is one of the best ways to earn a massive amount of points that you can put towards that dream vacation of yours. And when you use the points, the cost of your dream vacation will most likely be (nearly) free.

Whether you have a ton of experience in points & miles, or you are just hearing of the term “points & miles” for the first time today, there is opportunity for anyone and everyone at all levels.

Stick around to learn about the best way to keep track of all your travel credit cards.

Intro to Travel Credit Cards

I have not always had a good relationship with credit cards, but after learning how to use them the correct way, I will never go back! Believe it or not, credit cards are a lucrative tool that can help you travel where you want for (nearly) free!

If you didn’t know, many credit card companies offer cards that have fairly large welcome bonuses when you open a card and spend a specific amount of money in a certain amount of time (i.e. spending $2,000 in 6 months). In addition, the companies offer rewards programs that allow cardholders to earn points or miles with everyday purchases.

These points can then be redeemed for free flights (just pay taxes), hotel stays, or other travel-related expenses. Additionally, many travel credit cards come with perks such as free checked bags, airport lounge access, and travel insurance, which can help reduce the cost of your travels even more. By strategically using credit cards to earn rewards and taking advantage of the associated perks, it is possible to travel for (nearly) free – all the time.

Multiple Cards

When you begin to use points & miles, it is easy to start with one card, but when you see bonus after bonus, it can quickly turn to multiple cards.

As you continue down this path, you may find yourself opening more and more credit cards to take advantage of the rewards they offer. While having multiple cards can be advantageous for earning points and miles, it can also be a challenge to keep track of them all.

You not only have to keep track of the specific cards, but you have to also keep track of their annual fees, minimum spends, closing dates, and payment dates. They add up fast.

To combat this, I use two things: a spreadsheet and Travel Freely. Let’s break them down!

Spreadsheets

When you have multiple credit cards, there are a few things that you need to make sure that you’re doing. I’m sure I will go into this more in depth on a future post, but the primary item that I use a spreadsheet for is to keep track of my credit utilization. Believe it or not, but your credit utilization makes up 30% of your credit score and it is recommended that your credit utilization rate stay between 2-5%. The best way that I have found is by imputing all of your expenses (or totals) and calculate that against your credit limit. For instance, if your credit limit is $1,000, you should only have about $200-$500 posted on your statement.

Now, this does not mean that you only have to spend $200-$500. This just means that before your closing date, you should pay off the amount that will get you to the $200-$500. This means, if you spent $900 throughout the month, before your closing date, you need to pay at least $400. That way, once your statement balance posts, it will post as though you only spent $500 or less. And don’t worry, every dollar spent counts towards points and your minimum spend.

Travel Freely

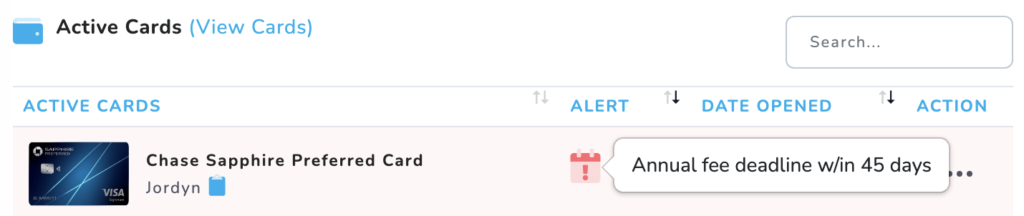

I use Travel Freely to keep track of pretty much everything besides my utilization. TF keeps track of your minimum spend, when your annual fees are due, when you are ready for a new credit card, and it even goes as far as to suggest new cards to you!

If you have more than one card (or plan to have more than one card), it is an absolute must.

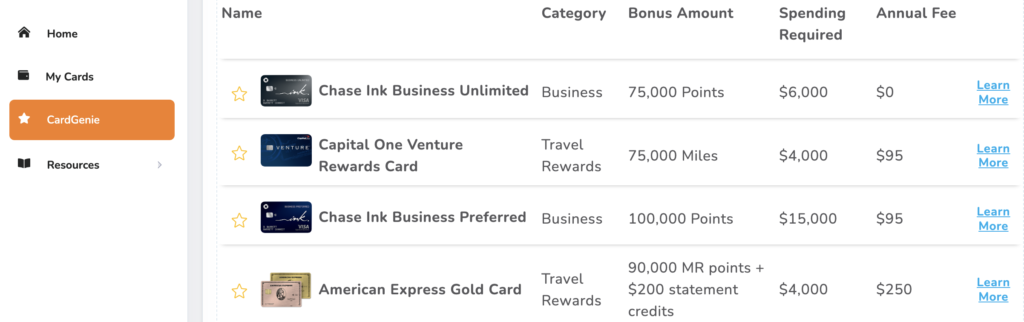

One of my favorite things that TF does is recommend new cards through the Card Genie. TF takes the cards you already have and suggests a new potential credit card in the portal.

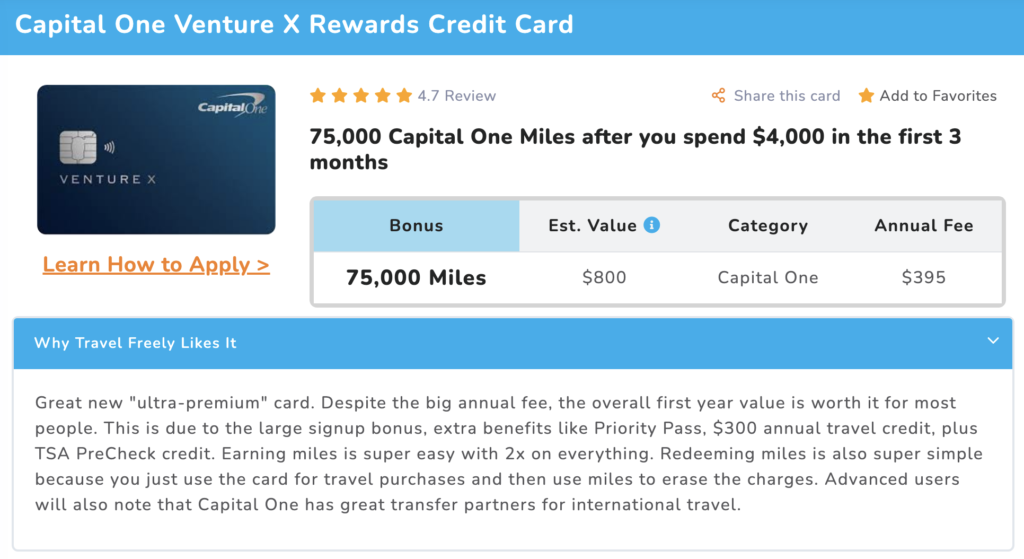

The best part, when you click on each card, it gives you a lot more information about the card so you can learn about spending categories and any other perk of the card. Usually, it’s not so easy to find all of this information in one place!

As a person with analysis paralysis, TF has come in handy more than a few times when deciding on a new credit card. And if you are thinking of opening more travel cards in the future, it is an absolute game changer.

If you want to give it a try, sign up here!

Do you have more than one credit card? If so, what do you use to keep track? I am always so curious!

Like this blog? Pin it!

* Oh hey, you there! Yeah you! Here are some important facts about travel credit cards that you should definitely not skip over! I’m not telling you what to do, but I’m kind of telling you what to do! If these next few items are not doable, you should not open a credit card right now. 1. Never inflate your spending just to hit a minimum spend on a credit card! 2. Always set up autopay on the credit card immediately after receiving the card to ensure that you will never miss a payment. Oh yeah, and one more thing…do not open a credit card if you plan to carry a balance on your card. Make sure that you can pay off your card in full. On time. Every month.

* Please note, some of the links on this page are affiliate links for The Mobile Homie. They help support my free content at absolutely no cost to you!